Member? Please login

Turner & Townsend: International Construction Market Survey 2023

Written by BCCJ

July 13, 2023

Member News

BCCJ member Turner & Townsend has published their International Construction Market Survey for 2023. Now in its 14th year of publication, the survey brings together data, industry insights and experience, covering 89 global markets. The report takes stock of how the construction industry is performing and examines the challenges it faces – and how these can be mitigated.

The survey pays a particular focus on Japan which continues to grow significant construction pipelines but faces greater challenges due to areas including skilled labour shortages and rising construction costs.

Please find below the International Construction Market Survey press release…

Emerging markets propel Asian construction growth while established economies enjoy strong project pipelines despite rising construction costs

•Latest International Construction Market Survey shows emerging markets such as India, Indonesia,Malaysia, Vietnam and the Philippines are warming up amid significant investments in real estate,and growing expansion of data centres, manufacturing and life sciences.

•Longstanding investment hotspots including Tokyo, Osaka and Singapore experience significantconstruction cost inflation on the back of skills shortages and high labour costs, as project pipelinesremain strong.

•Japan is the most expensive Asian market to build in.

•Hong Kong remains one of the most expensive markets to build in globally, despite dropping to 11thplace in the rankings from 7th in 2022.

Tokyo, Japan, 26 June 2023 – Global professional services consultancy Turner & Townsend has launched the 14th edition of its International Construction Market Survey (ICMS), which reports positive levels of construction activity across the majority of Asian markets.

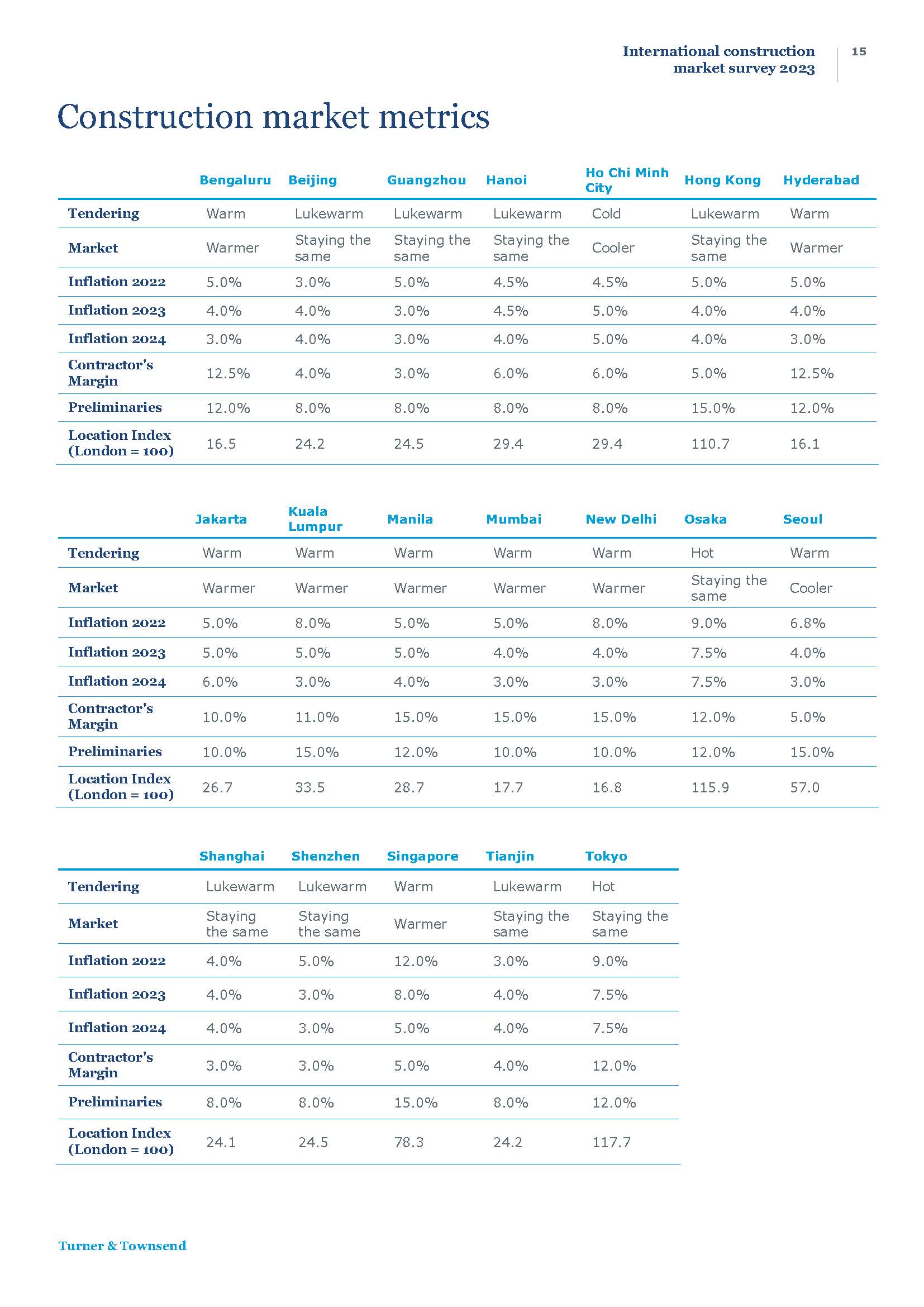

The report analyses input costs – such as labour and materials – and charts the average construction cost per square metre (m2) for commercial, residential and industrial projects in 89 markets around the world.

Established markets see strong pipelines amid ongoing challenges

Established markets for real estate development such as Japan, Singapore, Hong Kong and South Korea are seeing demand and strong pipelines across multiple sectors. These markets, however, continue to face ongoing challenges posed by skills shortages and rising labour costs.

Japan, an established market in the region, sees its economy starting to gain momentum, with the IMF forecasting 1.3 percent growth in 2023; an increase from 1.1 percent in 2022 after a prolonged period of limited growth.

Construction costs in Tokyo and Osaka are some of the highest in the world, ranking fifth and sixth respectively in the top ten most expensive places to build. Average costs are US$4,497 per m2 in Osaka and US$4,567 per m2 in Tokyo. Singapore is ranked fourth in Asia and 31st globally, with an average cost of US$3,307 per m2 .

All three cities are seeing high levels of construction cost inflation, with rates in Tokyo and Osaka at 9 percent in 2022, softening to a forecast of 7.5 percent in 2023. Fuelling a strong backlog of construction projects in an already hot Japanese construction market is the upcoming 2025 World Expo in Osaka. As a result, construction cost inflation in Japan is likely to remain high.

Singapore experienced the highest rate of cost escalation in Asia in 2022 – at 12 percent. It is expected to remain high at 8 percent in 2023 as the market continues to be faced with skills capacity challenges, high labour and material costs.

Hong Kong remains one of the most expensive markets to build globally despite dropping from the 7th to 11th position this year, with an average cost of US$4,292 per m2 . The city has been overtaken in the top ten spots which are dominated by US cities, reflecting the strength of the US dollar, and the double-digit construction cost inflation in many of the US cities.

Strong growth driver from emerging markets in Asia

Emerging markets including India, Indonesia, Malaysia, Vietnam and the Philippines are warming up, driven by strong pipelines of major multi-year transport projects, data centre and manufacturing growth, and increasing activity by commercial developers.

Diverse sectors are the key for driving growth across Asia

Across the region, growth sectors for real estate construction include data centres, health and life sciences, in line with the local boom in development and delivery of medical technologies. Singapore, Hong Kong, and Shanghai in particular have announced plans to localise the development, production and delivery of vaccines and medical technologies through increased numbers of manufacturing facilities and research laboratories.

The industry’s push towards sustainability

The region is also feeling an increased pressure from the global push towards net zero. Global corporate occupiers have shifted sustainability up their priority lists and are applying more stringent requirements to their international portfolios, helping to establish supply chain expertise in environmental best practice and drive innovation in the built environment.

Japan, South Korea, and Singapore have pledged to reach net-zero emissions by 2050, China, by 2060. Tokyo has committed to a fixed percentage of all new houses including solar from 2025, and new feed-in tariffs have been approved to encourage more renewables. While Japan remains very dependent on imported fossil fuel energy, the country is focused on expanding its offshore wind farms, solar and green hydrogen.

Cheryl Lum, Director and Head of Data and Research at Turner & Townsend Asia said:

“The Asian construction industry has stayed resilient throughout the pandemic. There are strong pipelines across all Asian countries with construction growth and major investment directed to emerging markets in particular. More established markets such as Hong Kong, Japan, Singapore, and South Korea continue to see high construction demand despite Asia being home to some of the most expensive cities in the world to build in.

Asia’s diverse and ambitious market economies places it in a strong position to command sustained construction growth and attract investment, particularly in industrial, science & technology, healthcare, transport and real estate developments.

In an economic climate of rising construction costs and inflationary pressures, it is imperative for the construction industry to work collaboratively to raise efficiency and increase productivity through digitalisation, innovative technologies and upskilling of the value chain.

Common to all markets is the need for strong supply chain engagement from clients to understand capacity and capability, benchmark costs and closely manage project performance.”

Turner & Townsend K.K.

![]()