Member? Please login

Preparing for the 2023 Qualified Invoice Issuer Rules

Written by Sterling Content

July 24, 2023

Past Event Round Ups

The clock is ticking for businesses to prepare their operations for a new qualified invoice system to be introduced in Japan from October 2023. For businesses operating in Japan, preparing for the new system is crucial, according to international accounting and business advisory firm HLS Global.

“Many companies are requiring vendors or suppliers to be registered under the new invoicing system, and if you do not provide a registration number, it might affect your business with them,” Manjul Agrawal, director of business development at HLS Global, told attendees at an online event hosted by the British Chamber of Commerce in Japan in July.

“We are recommending clients get their registration numbers as soon as possible,” he added.

Agrawal and his colleague, Takashi Iizuka, partner at HLS Global, discussed the new system and its implementation during the webinar, entitled “Japanese Consumption Tax: Preparing for the 2023 Qualified Invoice Issuer Rules.”

Qualified invoice system

Japan’s new qualified invoicing system will closely follow the UK’s VAT invoicing system. In Japan, a 10% tax rate is levied on domestic sales of goods and services as well as upon importation. An 8% rate is applicable to certain food and beverage products, while some transactions such as exports are exempt.

Under the qualified invoicing system, all qualified invoices (where tax credits for Japanese Consumption Tax (JCT) are applicable) will require proper storage as per the stipulated guidelines. Otherwise, deductions through tax credits may not be applicable, and the amount of JCT payments may increase, according to HLS Global.

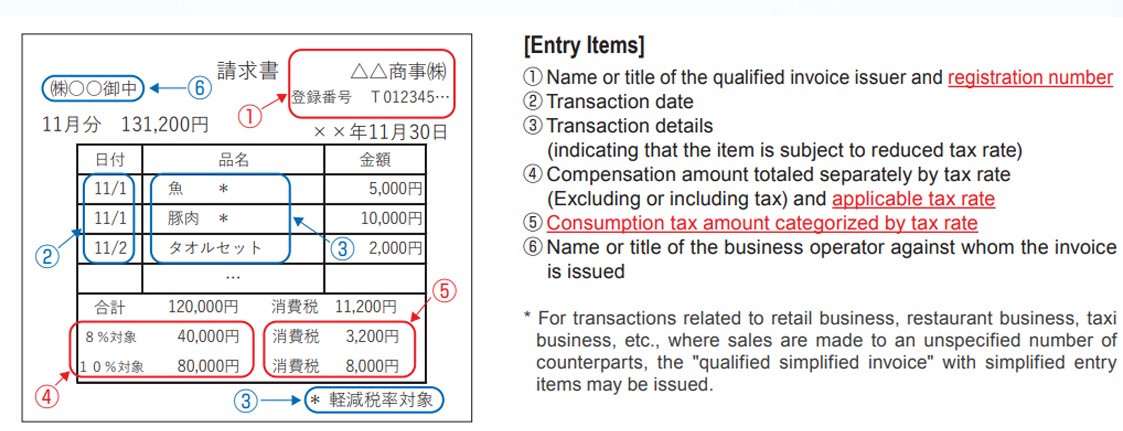

A “qualified invoice” is an invoice or receipt issued by a qualified invoice issuing company, with six components:

-Name and registered number of the qualified invoice issuer

-Transaction date

-Transaction details (clarification of any item subject to reduced tax rate of 8%)

-Transaction amount (display respective amounts by applicable tax rate)

-Consumption tax amount along with applicable tax rate

-Name of counterparty to whom the invoice is issued

The input of a registered number and JCT along with the applicable tax rate is a key differentiator from the current invoicing system, Iizuka said.

A qualified invoice issuer is described as a taxpaying business that has applied to the tax office and been registered as a qualified invoice issuer. Upon registration, the business will be given a registered number, which will be available along with the company name on the National Tax Agency website, according to HLS Global.

Businesses can apply to become a qualified invoice issuer by submitting an “Eligible Invoice Issuer Application.”

Should your business register?

A current taxpaying entity is eligible to become a qualified invoice issuer. Failure to do so would mean the business cannot issue a qualified invoice and input tax credit would not be applicable for the invoice receiver. It could even result in the “suspension of trading transactions or discount requests to equalise the amount of non-deducted consumption tax,” according to HLS Global.

Non-taxpaying or tax-exempted entities cannot become qualified invoice issuers without first becoming taxpaying businesses. To do so, they would have to waive the benefits of JCT exemption to become qualified invoice issuers.

“It is recommended that you consider the impact on your business before deciding to become a qualified invoice issuer or not, especially if you are in a B2B business,” Iizuka said.

For a non-taxpaying entity, becoming a qualified invoice issuer enables them to issue such invoices, with no risk of business loss due to consumption tax issues or being asked to offer discounts to equalise the value of JCT. However, as well as losing tax exemption benefits, there is an increased cost due to professional fees incurred from filing JCT returns.

Transitional measures

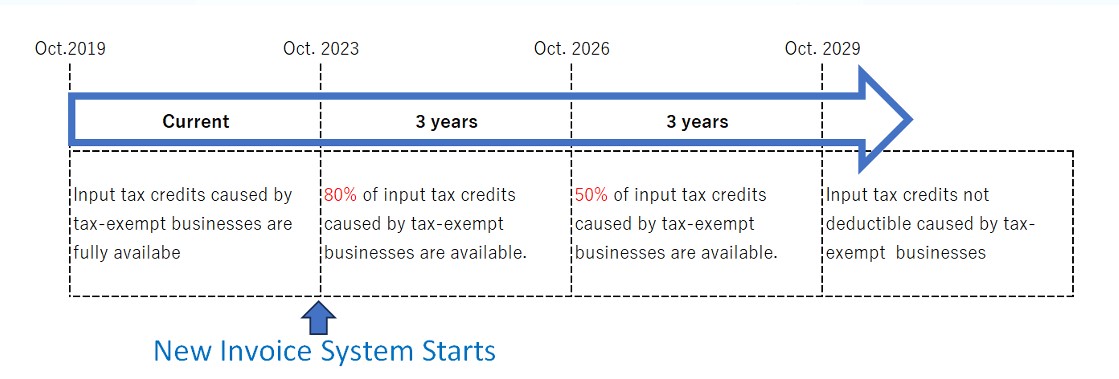

The Japanese government has put six-year transitional measures in place to mitigate the impact of the new invoicing system.

-For an invoice issued by a non-taxpaying entity between October 2023 and September 2026, only 80% of the consumption tax is eligible for tax credits for the invoice receiver

-For an invoice issued by a non-taxpaying entity between October 2026 and September 2029, only 50% of the consumption tax is eligible for tax credits for the invoice receiver

-For all invoices issued after October 2029, no tax credits on consumption tax will be available for the invoice receiver.

Vendor, employee guidelines

HLS Global suggests businesses request vendors become qualified invoice issuers. Alternatively, it is possible to request a discount equivalent to the non-deductible consumption tax amount, subject to certain conditions.

HLS Global recommends employers ask their employees to check the receipts they receive to ensure they have the necessary registration number. However, for some payments under ¥30,000, a qualified invoice is not required, such as for the use of public transport, coin lockers and vending machines.

“It is important to instruct employees to avoid using services from non-qualified invoice issuers whenever possible,” Iizuka said. “When employees receive a receipt from these businesses, they should verify if the registration number is stated and confirm whether they are a qualified business or not.”

Asked about accounting software for the new system, Agrawal said Japanese software systems should already incorporate the change, however businesses using global systems such as SAP may need to consult their vendor.

Another development will be the requirement for a time stamp for invoices sent via email, with the enforcement of the Electric Bookkeeping Law pertaining to electronic transactions coming into force on January 1, 2024.

HLS Global encouraged businesses to consider the impacts of the new system on their IT systems as well as the need to renegotiate contract terms with third parties.

With the new system’s introduction only months away, businesses operating in Japan are recommended to act now and seek professional advice if needed, said the event speakers.