Member? Please login

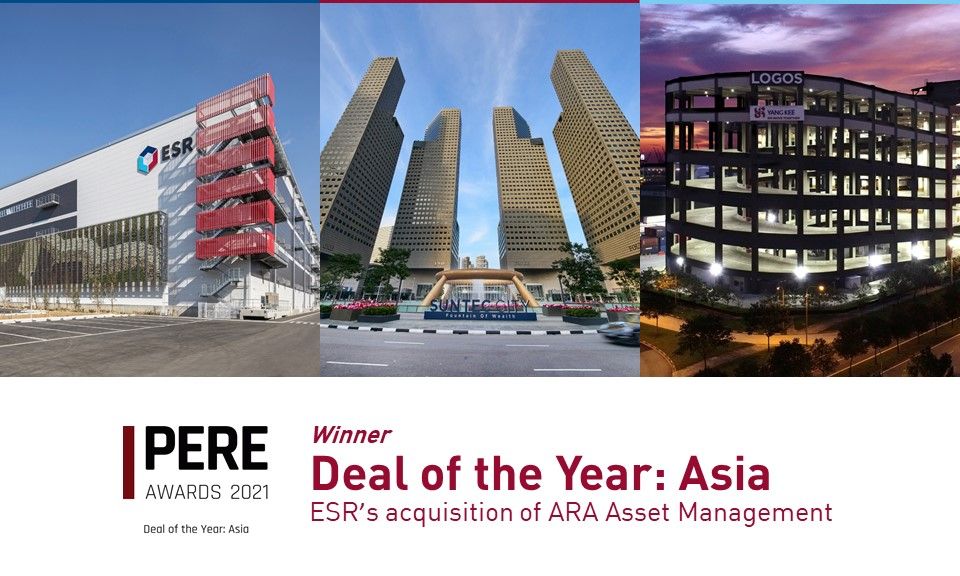

ESR’s acquisition of ARA named “Deal of the Year: Asia” in 2021 PERE Global Awards

Written by BCCJ

March 2, 2022

Member News

HONG KONG, 1 March 2022 – ESR Cayman Limited (“ESR” or the “Company”, together with its subsidiaries as the “Group”; SEHK Stock Code: 1821), APAC’s largest real asset manager powered by the New Economy, is pleased to announce that the Group’s acquisition of ARA Asset Management (“ARA”) was named “Deal of the Year: Asia” at the 2021 PERE Global Awards. Jeffrey Perlman, Chairman of ESR who is also Head of Asia Pacific Real Estate and Southeast Asia at Warburg Pincus, was named “Industry Figure of the Year: Asia”.

Mr. Perlman remarked: “2021 was a milestone year for ESR, highlighted by a series of highly successful deals and events including the acquisition of ARA which has transformed ESR into Asia Pacific’s largest real asset manager and the world’s third largest listed real estate investment manager. We are honoured to be recognised by the industry for the tremendous efforts and dedication of the team at ESR. As an enlarged platform, we look forward to the next phase of growth leveraging our vastly expanded scale, offerings and capabilities to provide a full suite of New Economy real estate development products and real asset investment solutions that deliver meaningful and sustainable value for our shareholders and stakeholders.”

Jeffrey Shen and Stuart Gibson, Co-founders and Co-CEOs of ESR, said: “We thank PERE, our peers, capital partners, customers and business partners for recognising our effort in this landmark transaction that has brought together the best-in-class platforms of ESR, ARA and LOGOS. Most importantly, we could not have earned this accolade without the hard work our teams across functions and markets do every day to drive the sustainable growth of ESR’s business.”

In January 2022, ESR completed its acquisition of ARA, including its subsidiary LOGOS, in a US$5.2 billion transaction. Today, ESR is APAC’s #1 real asset manager powered by the New Economy and the third largest listed real estate investment manager globally with a gross AUM of US$140 billion1 . As the largest New Economy real estate platform and sponsor of REITs in APAC, ESR is uniquely positioned to capitalise on the largest secular trends in the region, including the continued rise of e-commerce, an accelerating digital transformation and the financialisation of real estate.

PERE is a leading publication for the world’s private real estate markets. The PERE Global Awards stand as one of the industry’s most prestigious honours, recognising investors, managers, advisors and individuals that have made significant achievements and impact in the private equity real estate market over the past year.

========

About ESR

ESR is APAC’s largest real asset manager powered by the New Economy and the third largest listed real estate investment manager globally. With US$140 billion in gross assets under management (AUM), our fully integrated development and investment management platform extends across key APAC markets, including China, Japan, South Korea, Australia, Singapore, India, New Zealand and Southeast Asia, representing over 95% of GDP in APAC, and also includes an expanding presence in Europe and the U.S. We provide a diverse range of real asset investment solutions and New Economy real estate development opportunities across our private funds business, which allow capital partners and customers to capitalise on the most significant secular trends in APAC. With 14 listed REITs managed by the Group and its associates, ESR is the largest sponsor and manager of REITs in APAC with a total AUM of US$45 billion. Our purpose – Space and Investment Solutions for a Sustainable Future – drives us to manage sustainably and impactfully and we consider the environment and the communities in which we operate as key stakeholders of our business. Listed on the Main Board of The Stock Exchange of Hong Kong, ESR is a constituent of the FTSE Global Equity Index Series (Large Cap), Hang Seng Composite Index and MSCI Hong Kong Index. More information is available at www.esr.com.